Many Filipinos were caught off guard when Bank of the Philippine Islands (BPI) removed GCash and Maya from its “Load E-Wallet” options last Thursday (February 13, 2025). This left many scrambling for an alternative to InstaPay, while others are threatening to just close their accounts as direct transfers to these e-wallets now incur fees ranging from Php 25 to Php 50. But don’t worry, we found a way to help you save a few pesos! This involves some additional steps involving Vybe, BPI’s own rewards app, to make free transfers to your e-wallet.

Here’s how to do it step by step:

Step 1: Download and set up the Vybe app

Vybe is a BPI-powered rewards and payment app so you can ensure that it’s 100% legit. Just download the app from the Google Play Store or Apple App Store. Once installed, follow these steps:

- Open the app and sign up using your BPI-registered mobile number.

- Link your BPI account to Vybe.

- Complete the verification process, if prompted.

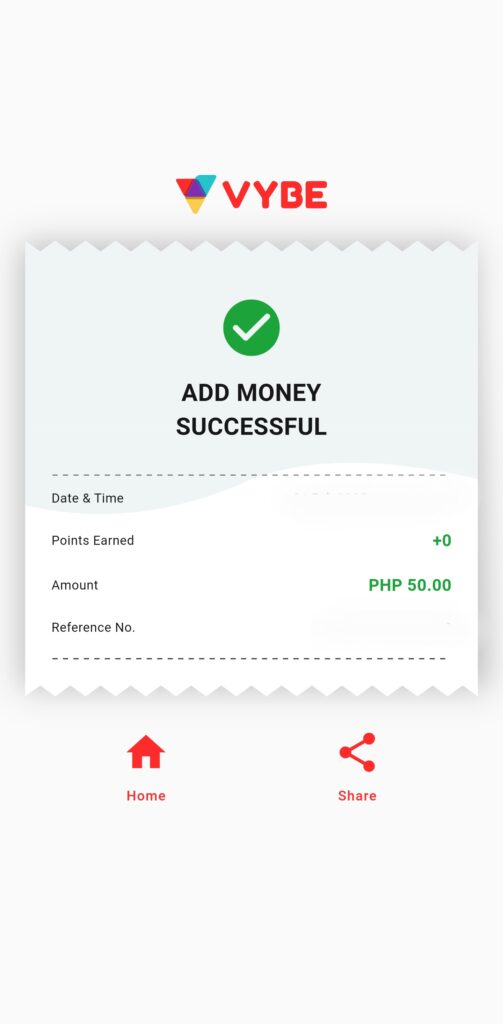

Step 2: Add money to your Vybe Wallet from BPI

Once your BPI account is linked to Vybe, you can easily transfer money to your Vybe wallet.

- Open the Vybe app and tap on VYBE eWallet.

- Tap on + Add Money.

- Select your BPI Account from the dropdown menu.

- Enter the amount you wish to transfer and click on Next.

- Confirm the transaction by entering the 6-digit code sent via SMS. The amount will be instantly reflected in your Vybe wallet.

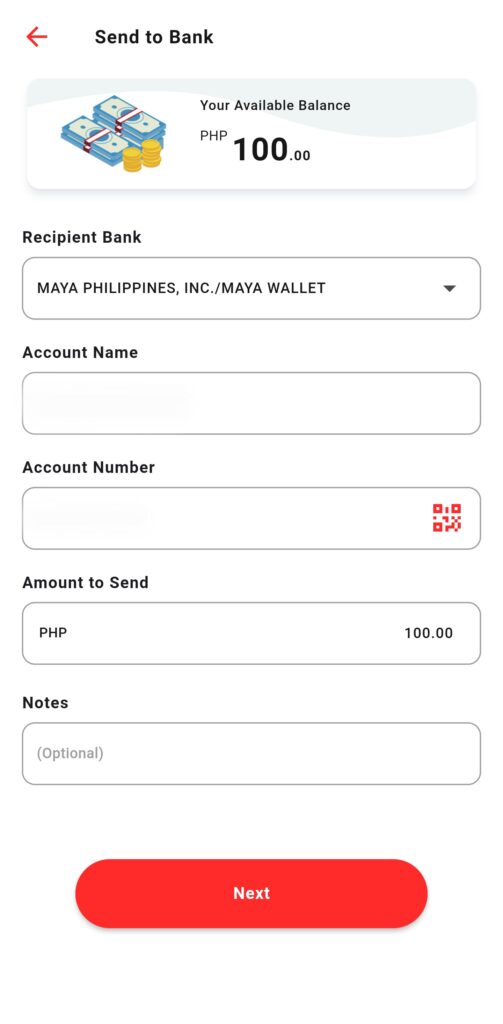

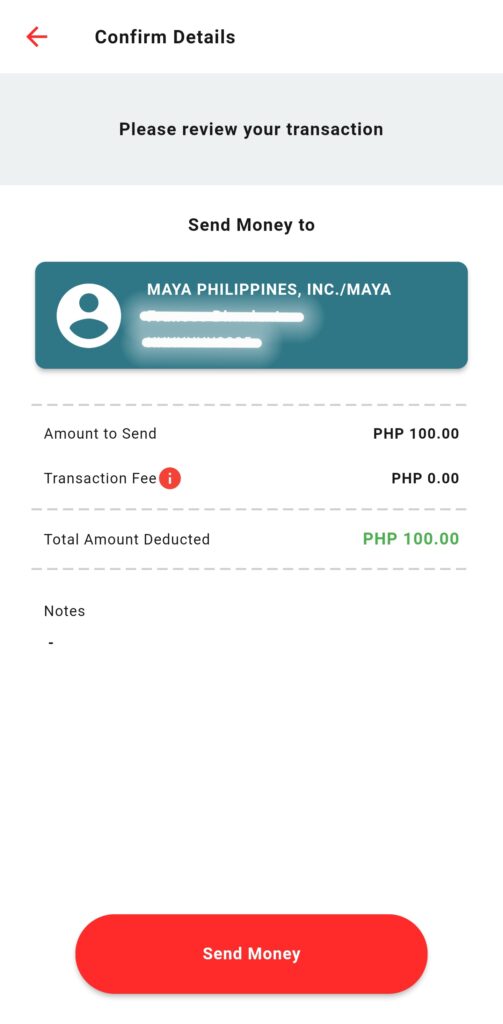

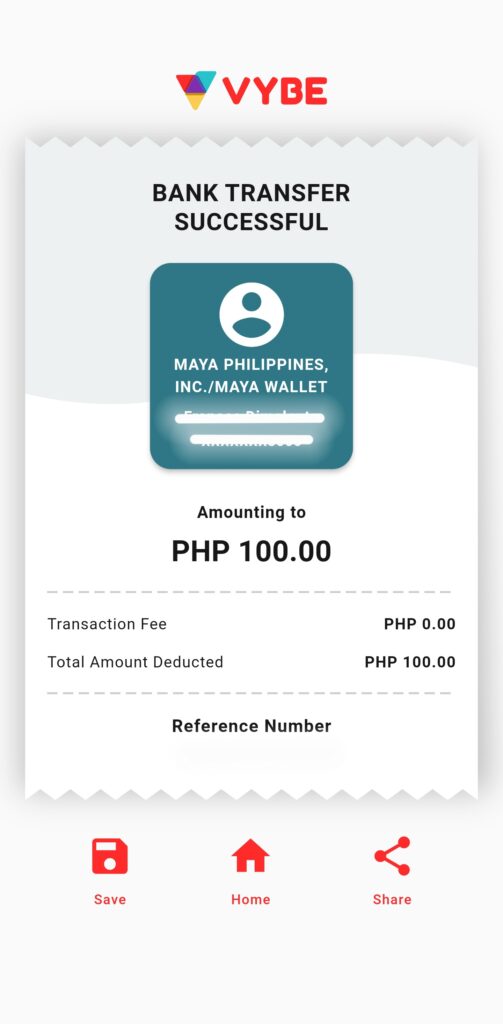

Step 3: Transfer Funds from Vybe to Your E-Wallet

- Go back to the VYBE eWallet section and select Send to Bank.

- Choose G-Xchange/GCash or Maya Philippines, Inc./Maya Wallet as the recipient bank.

- Enter the account name and mobile number linked to your chosen e-wallet.

- Input the amount you wish to transfer and confirm the transaction by entering your MPIN.

- The funds will be credited to your e-wallet instantly without a transaction fee.

It’s my first time using this app and I honestly wouldn’t have discovered it if BPI didn’t remove GCash and Maya in their e-wallet options. The app also allows you to access BPI Rewards where you can redeem discounts from select stores, as well as view promo mechanics from their partner merchants.

With banks and financial apps continuously updating their services, knowing about alternative methods like this can save you a lot of money in the long run. Php 25 is no joke in this economy! Share this guide with friends and family who regularly transfer from BPI to GCash or Maya. It’s a simple hack that keeps your hard-earned money where it belongs!

P.S. This is not a sponsored post. Like you, I’m just looking for alternatives so if you have other suggestions, feel free to let me know, too!

For updates on our latest discoveries within (and outside) the Metro, don’t forget to follow Manila Millennial on Facebook, YouTube, TikTok, or Instagram.

Ganito Pala Ms.ces at salamat Sa Pagbabahagi Nito

Ang gandang app naman po yan at walang fee. Thanks for sharing this po napakalaking help po nito.

Astig ng Vybe app kaya dapat mag download na sayang din ng transaction fee sa iba.