Have you ever found yourself on a month-long vacation in a foreign country, only to realize you forgot to pay your bills back home? Or needed to send funds urgently for an emergency, but your digital wallet wasn’t accessible outside the Philippines? Making financial transactions while traveling or working abroad has been a challenge for many individuals. Recognizing such needs, finance app GCash has recently unveiled GCash Overseas, extending its reach to Filipinos in 16 key markets worldwide.

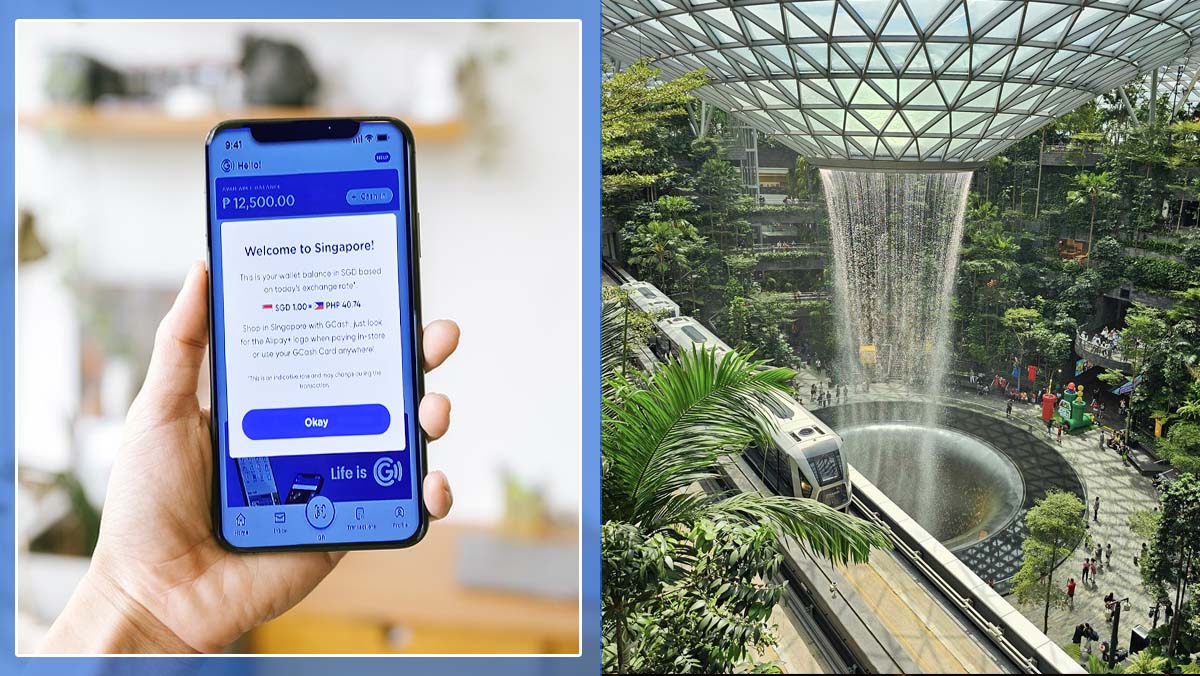

This expansion is aimed to empower overseas Filipinos with seamless digital financial services, revolutionizing the way they manage money and stay connected with their loved ones back home. Now, Filipinos residing in the United States, Canada, the United Kingdom, Spain, Italy, Germany, Qatar, Kuwait, Japan, South Korea, Taiwan, Singapore, Hong Kong, and Australia can easily download and make transactions using the GCash app, regardless of whether they have Philippine SIM cards or local mobile phone numbers.

Just think of all the headache it spares Overseas Filipino Workers (OFWs) with: No need to rely on other family members for updates on whether bills have been paid, no more waiting for 24 hours for emergency fund transfers, and no need to worry about budgeting or checking where your money is going – from household utilities to tuition fees. Buying load for loved ones even while abroad is also possible, by the way! This saves us from the excuse of not having mobile load to stay connected all the time.

“We recognize the financial needs of over 13 million Filipinos living abroad. With GCash now available beyond the Philippines, we are responding to the needs of global Filipinos in these cashless digital economies, providing them with a safe, secure, and efficient fintech solution to send money back home,” explained Paul Albano, General Manager of GCash International.

Moreover, GCash is committed to providing a comprehensive suite of digital financial services beyond money transfers. From savings to gifting vouchers and online payments, GCash empowers overseas Filipinos to manage their finances efficiently and securely.

To further extend its reach to OFWs, GCash has partnered with Ikon Solutions Asia, Inc., a renowned recruitment agency, to equip OFWs with essential digital financial tools through the app. This strategic collaboration aims to enhance the financial well-being of Filipinos working abroad.

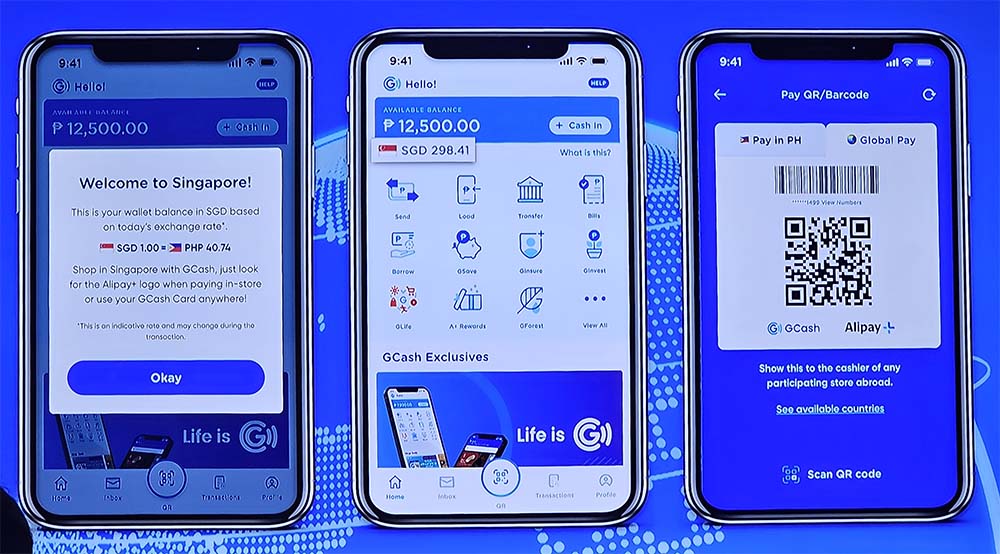

In addition to these partnerships, GCash has also joined forces with global payments platform Alipay+ and international payments giant Visa, enhancing its capabilities as a cashless payment solution worldwide. Through Alipay+’s Global Pay, GCash users can conveniently transact with over 3 million merchants in 17 countries and territories, enjoying low foreign exchange rates and zero service fees. This integration with Visa provides GCash users with another convenient payment method outside the Philippines, offering greater flexibility and accessibility.

Paul Albano expressed optimism about GCash’s international expansion, emphasizing the company’s commitment to providing seamless financial services to Filipinos worldwide. With innovation and strategic partnerships at the forefront, GCash aims to redefine digital payments for Overseas Filipinos, marking the beginning of an exciting journey towards global financial inclusion.

A really great move for GCash! Wish we’d see it in more countries very soon!

For updates on our latest discoveries within (and outside) the Metro, don’t forget to follow Manila Millennial on Facebook, YouTube, or Instagram. Keep safe, everyone!

This is so nice ms.cess. Gcash goes international so convenient easy transaction send money pay bills laking tulong nito ..im a gcash user love their service..d best!!!

That’s really good news Ms.Ces

At napakaconvenient talaga itong Gcash